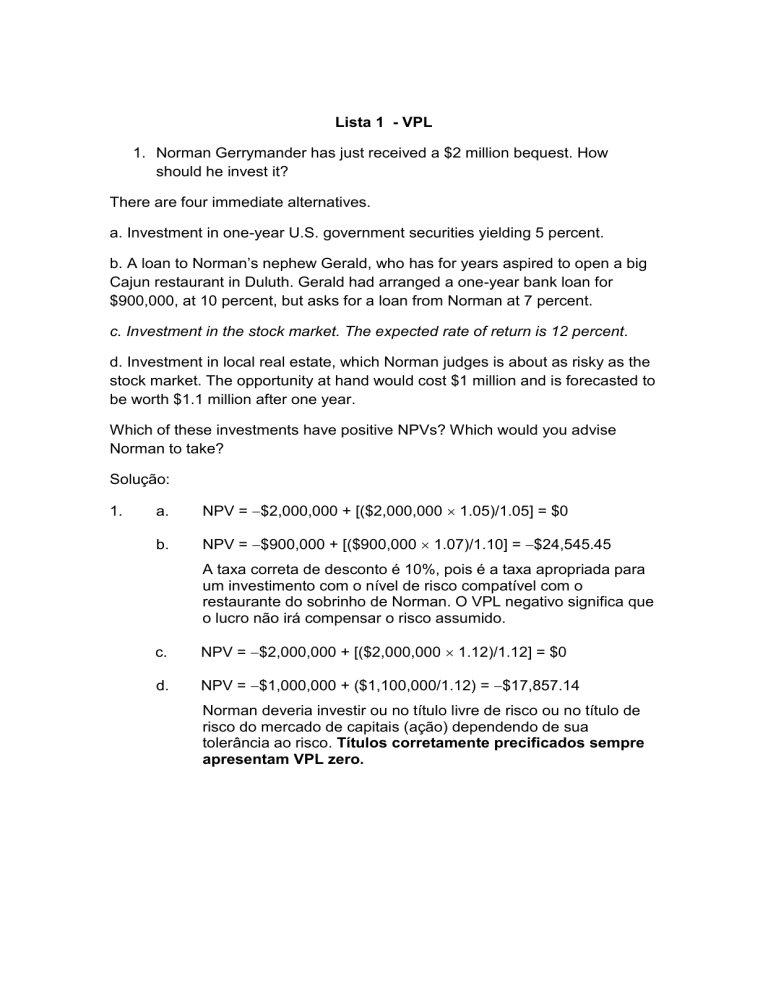

Lista 1 - VPL

1. Norman Gerrymander has just received a $2 million bequest. How

should he invest it?

There are four immediate alternatives.

a. Investment in one-year U.S. government securities yielding 5 percent.

b. A loan to Norman’s nephew Gerald, who has for years aspired to open a big

Cajun restaurant in Duluth. Gerald had arranged a one-year bank loan for

$900,000, at 10 percent, but asks for a loan from Norman at 7 percent.

c. Investment in the stock market. The expected rate of return is 12 percent.

d. Investment in local real estate, which Norman judges is about as risky as the

stock market. The opportunity at hand would cost $1 million and is forecasted to

be worth $1.1 million after one year.

Which of these investments have positive NPVs? Which would you advise

Norman to take?

Solução:

1.

a.

NPV = $2,000,000 + [($2,000,000 1.05)/1.05] = $0

b.

NPV = $900,000 + [($900,000 1.07)/1.10] = $24,545.45

A taxa correta de desconto é 10%, pois é a taxa apropriada para

um investimento com o nível de risco compatível com o

restaurante do sobrinho de Norman. O VPL negativo significa que

o lucro não irá compensar o risco assumido.

c.

NPV = $2,000,000 + [($2,000,000 1.12)/1.12] = $0

d.

NPV = $1,000,000 + ($1,100,000/1.12) = $17,857.14

Norman deveria investir ou no título livre de risco ou no título de

risco do mercado de capitais (ação) dependendo de sua

tolerância ao risco. Títulos corretamente precificados sempre

apresentam VPL zero.

2.

For an outlay of $8 million you can purchase a tanker load of bucolic acid

delivered in Rotterdam one year hence. Unfortunately the net cash flow

from selling the tanker load will be very sensitive to the growth rate of the

world economy:

Slump

Boom

Normal

$8 million

$12 million

$16 million

a. What is the expected cash flow? Assume the three outcomes for the

economy are equally likely.

b. What is the expected rate of return on the investment in the project?

c. One share of stock Z is selling for $10. The stock has the following

payoffs after one year:

Slump Boom

Normal

$8

$12

$16

Calculate the expected rate of return offered by stock Z. Explain why this

is the opportunity cost of capital for your bucolic acid project.

d. Calculate the project’s NPV. Is the project a good investment? Explain

why.

Solução:

2.

a.

Fluxo de Caixa Esperado = ($8 million + $12 million + $16

million)/3 = $12 million

b.

Taxa de retorno Esperada = ($12 million/$8 million) – 1 = 0.50 =

50%

c.

Fluxo de Caixa Esperado = ($8 + $12 + $16)/3 = $12

Taxa de retorno Esperada = ($12/$10) – 1 = 0.20 = 20%

Seu o negócio da empresa é a compra e venda deste produto, o payoff

do produto deve ser o mesmo que o payoff das ações em cada estado

da economia. O risco dos fluxos de caixa é o mesmo.

d.

NPV = - $8,000,000 + ($12,000,000/1.20) = +$2,000,000

O projeto é um bom investimento porque o VPL é positivo.

3.

Ms. Smith is retired and depends on her investments for retirement

income. Mr. Jones is a young executive who wants to save for the future.

They are both stockholders in Airbus, which is investing over $12 billion

to develop the A380, a new super-jumbo airliner. This investment’s

payoff is many years in the future. Assume the investment is positiveNPV for Mr. Jones. Explain why it should also be positive-NPV for Ms.

Smith.

Solução:

The investment’s positive NPV will be reflected in the price of Jumbo

stock. In order to derive a cash flow from her investment that will allow

her to spend more today, Ms. Espinoza can sell some of her shares at

the higher price or she can borrow against the increased value of her

holdings.